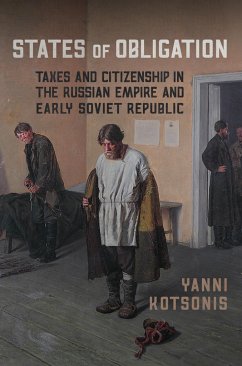

Yanni Kotsonis

States of Obligation

Taxes and Citizenship in the Russian Empire and Early Soviet Republic

Yanni Kotsonis

States of Obligation

Taxes and Citizenship in the Russian Empire and Early Soviet Republic

- Broschiertes Buch

- Merkliste

- Auf die Merkliste

- Bewerten Bewerten

- Teilen

- Produkt teilen

- Produkterinnerung

- Produkterinnerung

States of Obligation is the first sustained study of the Russian taxation system, the first to study its European and transatlantic context, and the first to expose the essential continuities between the fiscal practices of the Russian Empire and the Soviet Union.

Andere Kunden interessierten sich auch für

![Land and Taxation Land and Taxation]() Nicolaus TidemanLand and Taxation18,99 €

Nicolaus TidemanLand and Taxation18,99 €![Rebellion, Rascals, and Revenue Rebellion, Rascals, and Revenue]() Michael KeenRebellion, Rascals, and Revenue35,99 €

Michael KeenRebellion, Rascals, and Revenue35,99 €![Taxing the Rich Taxing the Rich]() Kenneth ScheveTaxing the Rich28,99 €

Kenneth ScheveTaxing the Rich28,99 €![Rebellion, Rascals, and Revenue Rebellion, Rascals, and Revenue]() Michael KeenRebellion, Rascals, and Revenue16,99 €

Michael KeenRebellion, Rascals, and Revenue16,99 €![South-Western Federal Taxation 2025 South-Western Federal Taxation 2025]() Annette Nellen (San Jose State University)South-Western Federal Taxation 2025313,99 €

Annette Nellen (San Jose State University)South-Western Federal Taxation 2025313,99 €![Canada-U.S. Tax Comparisons Canada-U.S. Tax Comparisons]() John B. ShovenCanada-U.S. Tax Comparisons126,99 €

John B. ShovenCanada-U.S. Tax Comparisons126,99 €![How to Save Inheritance Tax 2025/26 How to Save Inheritance Tax 2025/26]() Carl BayleyHow to Save Inheritance Tax 2025/2636,99 €

Carl BayleyHow to Save Inheritance Tax 2025/2636,99 €-

-

-

States of Obligation is the first sustained study of the Russian taxation system, the first to study its European and transatlantic context, and the first to expose the essential continuities between the fiscal practices of the Russian Empire and the Soviet Union.

Produktdetails

- Produktdetails

- Verlag: University of Toronto Press

- Seitenzahl: 504

- Erscheinungstermin: 27. Juli 2016

- Englisch

- Abmessung: 226mm x 147mm x 30mm

- Gewicht: 768g

- ISBN-13: 9781487521653

- ISBN-10: 1487521650

- Artikelnr.: 45233357

- Herstellerkennzeichnung

- Libri GmbH

- Europaallee 1

- 36244 Bad Hersfeld

- gpsr@libri.de

- Verlag: University of Toronto Press

- Seitenzahl: 504

- Erscheinungstermin: 27. Juli 2016

- Englisch

- Abmessung: 226mm x 147mm x 30mm

- Gewicht: 768g

- ISBN-13: 9781487521653

- ISBN-10: 1487521650

- Artikelnr.: 45233357

- Herstellerkennzeichnung

- Libri GmbH

- Europaallee 1

- 36244 Bad Hersfeld

- gpsr@libri.de

Yanni Kotsonis is an associate professor in the Departments of History and of Russian and Slavic Studies and founding Director of the Jordan Center for the Advanced Study of Russia at New York University.

Introduction. A Short History of Taxes: Russia and the World from the

Eighteenth to the Twenty-First Centuries

Part 1. People, Places, Things: The Old Regime, Economic Knowledge, and the

Coming of the New Order

1. The Fiscal Instruments of Regime Change from the Eighteenth to the

Nineteenth Centuries

2 Three Tax Reforms, Three Visions of the Polity

Part 2. The Politics of Visibility, the Technologies of Intimacy: Taxes and

the Remaking of Urban and Commercial Russia

3. Wealth in Motion: New Money, New Taxes, and a New Bureaucracy

4. Systematic Intimacy: Business Taxes and the Disciplining of Commercial

Russia

5. Mass Taxation in the Age of the Individual: The New Personal Taxation in

Russia and the World

6. The Income Tax as Modern Government: Assessment, Self-Assessment, and

Mutual Surveillance

Part 3. The Politics of Obscurity: Peasant Taxes, Excises, and the Vodka

Monopoly to 1917

7. Everyone and No One: Indirect Taxes and the Vodka Monopoly to 1917

8. The Peasant and the Fisc: The State Budget and the Persistence of

Collective Tax Apportionment

9. The Local Practices of Peasant Taxation

Part 4. The State and Revolution, the State and Evolution: Fiscal Practices

and a New Regime, 1917–30

10. Soviet Russia and the Continuing History of the Russian State

11. The Meanings of Utopia: Taxes, Urban Unities, and the Several Assaults

on Peasant Separateness, 1917–21

12. The Economy of Licences: Taxes and the New Economic Policy

Afterword. Russia, Socialism, and the Modern State

Eighteenth to the Twenty-First Centuries

Part 1. People, Places, Things: The Old Regime, Economic Knowledge, and the

Coming of the New Order

1. The Fiscal Instruments of Regime Change from the Eighteenth to the

Nineteenth Centuries

2 Three Tax Reforms, Three Visions of the Polity

Part 2. The Politics of Visibility, the Technologies of Intimacy: Taxes and

the Remaking of Urban and Commercial Russia

3. Wealth in Motion: New Money, New Taxes, and a New Bureaucracy

4. Systematic Intimacy: Business Taxes and the Disciplining of Commercial

Russia

5. Mass Taxation in the Age of the Individual: The New Personal Taxation in

Russia and the World

6. The Income Tax as Modern Government: Assessment, Self-Assessment, and

Mutual Surveillance

Part 3. The Politics of Obscurity: Peasant Taxes, Excises, and the Vodka

Monopoly to 1917

7. Everyone and No One: Indirect Taxes and the Vodka Monopoly to 1917

8. The Peasant and the Fisc: The State Budget and the Persistence of

Collective Tax Apportionment

9. The Local Practices of Peasant Taxation

Part 4. The State and Revolution, the State and Evolution: Fiscal Practices

and a New Regime, 1917–30

10. Soviet Russia and the Continuing History of the Russian State

11. The Meanings of Utopia: Taxes, Urban Unities, and the Several Assaults

on Peasant Separateness, 1917–21

12. The Economy of Licences: Taxes and the New Economic Policy

Afterword. Russia, Socialism, and the Modern State

Introduction. A Short History of Taxes: Russia and the World from the

Eighteenth to the Twenty-First Centuries

Part 1. People, Places, Things: The Old Regime, Economic Knowledge, and the

Coming of the New Order

1. The Fiscal Instruments of Regime Change from the Eighteenth to the

Nineteenth Centuries

2 Three Tax Reforms, Three Visions of the Polity

Part 2. The Politics of Visibility, the Technologies of Intimacy: Taxes and

the Remaking of Urban and Commercial Russia

3. Wealth in Motion: New Money, New Taxes, and a New Bureaucracy

4. Systematic Intimacy: Business Taxes and the Disciplining of Commercial

Russia

5. Mass Taxation in the Age of the Individual: The New Personal Taxation in

Russia and the World

6. The Income Tax as Modern Government: Assessment, Self-Assessment, and

Mutual Surveillance

Part 3. The Politics of Obscurity: Peasant Taxes, Excises, and the Vodka

Monopoly to 1917

7. Everyone and No One: Indirect Taxes and the Vodka Monopoly to 1917

8. The Peasant and the Fisc: The State Budget and the Persistence of

Collective Tax Apportionment

9. The Local Practices of Peasant Taxation

Part 4. The State and Revolution, the State and Evolution: Fiscal Practices

and a New Regime, 1917–30

10. Soviet Russia and the Continuing History of the Russian State

11. The Meanings of Utopia: Taxes, Urban Unities, and the Several Assaults

on Peasant Separateness, 1917–21

12. The Economy of Licences: Taxes and the New Economic Policy

Afterword. Russia, Socialism, and the Modern State

Eighteenth to the Twenty-First Centuries

Part 1. People, Places, Things: The Old Regime, Economic Knowledge, and the

Coming of the New Order

1. The Fiscal Instruments of Regime Change from the Eighteenth to the

Nineteenth Centuries

2 Three Tax Reforms, Three Visions of the Polity

Part 2. The Politics of Visibility, the Technologies of Intimacy: Taxes and

the Remaking of Urban and Commercial Russia

3. Wealth in Motion: New Money, New Taxes, and a New Bureaucracy

4. Systematic Intimacy: Business Taxes and the Disciplining of Commercial

Russia

5. Mass Taxation in the Age of the Individual: The New Personal Taxation in

Russia and the World

6. The Income Tax as Modern Government: Assessment, Self-Assessment, and

Mutual Surveillance

Part 3. The Politics of Obscurity: Peasant Taxes, Excises, and the Vodka

Monopoly to 1917

7. Everyone and No One: Indirect Taxes and the Vodka Monopoly to 1917

8. The Peasant and the Fisc: The State Budget and the Persistence of

Collective Tax Apportionment

9. The Local Practices of Peasant Taxation

Part 4. The State and Revolution, the State and Evolution: Fiscal Practices

and a New Regime, 1917–30

10. Soviet Russia and the Continuing History of the Russian State

11. The Meanings of Utopia: Taxes, Urban Unities, and the Several Assaults

on Peasant Separateness, 1917–21

12. The Economy of Licences: Taxes and the New Economic Policy

Afterword. Russia, Socialism, and the Modern State