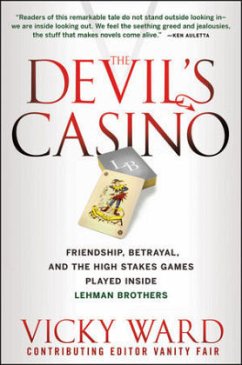

Das Scheitern von Lehman Brothers und die Entscheidung, die altehrwürdige Investmentbank untergehen zu lassen, wird Jahrzehnte für Diskussionsstoff sorgen. Während die meisten Analysten, Experten und Investoren sich auf ungesicherte Hypothekenkredite, ?faule? Sicherheiten und Abfindungen und Boni für die Managementebene fokussierten, konzentrierten sich einige wenige Blicke auf den berüchtigten Vorstandsvorsitzenden bei Lehman, Dick Fuld. Denn es gibt eine größere Geschichte, die in den Blickpunkt geraten wird, sobald sich der Tumult legt, und diese Geschichte heißt: Warum wurde Lehman gestattet zu scheitern und wer genau setzte sich für den Niedergang ein? Welche Beweggründe gab es? Wussten die in den Untergang Lehmans verstrickten Akteure, was sie taten, und um die Konsequenzen? Oder opferten sie lieber die Bank, um so selbst ungeschoren davonzukommen ? mit katastrophalen Folgen. Nur Vicky Ward, eine Insiderin unter den Journalisten, Autorin für Vanity Fair und Kolumnistin beim

Evening Standard, hat Zugang zu den Schlüsselfiguren und das notwendige Verständnis für die Finanzwelt, um enthüllen zu können, was genau am Wochenende des 14. September geschah und zu welch schrecklichen Konsequenzen dies führte. Es ging nicht so sehr darum, dass die Anteilseigner ausradiert wurden oder sogar die Fremdkapitalgeber , sondern es ging um die aufbrausende Schockwirkung, als sich zahllose Kunden und Geschäftspartner um ihr Geld betrogen sahen, und um eine Entwicklung, die zu dem anschließenden Chaos führte, unter dem die Welt noch heute leidet. Wie konnte dies geschehen, während die Bank of America, Merrill Lynch, Bear Stearns, AIG, Fannie Mae und Freddie Mac, um nur einige zu nennen, gerettet wurden? Warum wurde IndyMac geschützt und WaMu in die Arme von Chase getrieben, Lehman aber erlaubt, in den Ruin zu gehen? Vicky Ward zeigt dies den Lesern in der dünnen Luft der Wall Street, wo selbst die Top-Vorstände nach Luft schnappen, in einer Welt höchster Einsätze, in der es um das finanzielle Überleben geht.

Von Hochzeitsfeiern bis hin zu Konferenzen, auf denen die Hauptfiguren, von denen man annahm, sie seien dort, nicht erschienen -

Vicky Ward enthüllt, was an jenem schicksalhaften Wochenende und in den der Finanzkrise vorangegangenen wirklich geschah. Sie demaskiert die tatsächlichen Schlüsselfiguren und legt ihre Beweggründe offen. Sie stellt eine Welt dar, in der die sogenannten ?bad guys? letztlich gar nicht so übel erscheinen, und die weißen Ritter nicht so makellos sind, wie wir dachten.

Evening Standard, hat Zugang zu den Schlüsselfiguren und das notwendige Verständnis für die Finanzwelt, um enthüllen zu können, was genau am Wochenende des 14. September geschah und zu welch schrecklichen Konsequenzen dies führte. Es ging nicht so sehr darum, dass die Anteilseigner ausradiert wurden oder sogar die Fremdkapitalgeber , sondern es ging um die aufbrausende Schockwirkung, als sich zahllose Kunden und Geschäftspartner um ihr Geld betrogen sahen, und um eine Entwicklung, die zu dem anschließenden Chaos führte, unter dem die Welt noch heute leidet. Wie konnte dies geschehen, während die Bank of America, Merrill Lynch, Bear Stearns, AIG, Fannie Mae und Freddie Mac, um nur einige zu nennen, gerettet wurden? Warum wurde IndyMac geschützt und WaMu in die Arme von Chase getrieben, Lehman aber erlaubt, in den Ruin zu gehen? Vicky Ward zeigt dies den Lesern in der dünnen Luft der Wall Street, wo selbst die Top-Vorstände nach Luft schnappen, in einer Welt höchster Einsätze, in der es um das finanzielle Überleben geht.

Von Hochzeitsfeiern bis hin zu Konferenzen, auf denen die Hauptfiguren, von denen man annahm, sie seien dort, nicht erschienen -

Vicky Ward enthüllt, was an jenem schicksalhaften Wochenende und in den der Finanzkrise vorangegangenen wirklich geschah. Sie demaskiert die tatsächlichen Schlüsselfiguren und legt ihre Beweggründe offen. Sie stellt eine Welt dar, in der die sogenannten ?bad guys? letztlich gar nicht so übel erscheinen, und die weißen Ritter nicht so makellos sind, wie wir dachten.

"Contains some fascinating pen-portraits of Lehman's characters--Mr Fuld and his sycophantic court . . . ." (The Economist Online)

"Ward sheds light on the four childhood friends who planned to take the financial world by storm while keeping their heads on their shoulders, and how quickly the second part of the play fell by the wayside amidst a brutal corporate coup and bumbling mismanagement that brought the firm down. The Devil's Casino serves as both an impressive work of investigative journalism and a cautionary tale of the culture surrounding American finance." (The Daily Beast)

"Ward's book is rich on details . . . when Ward connects the dots, the rough conclusion she comes up with is that fatal flaws of Fuld's culture brought Lehman down." (Reuters)

"A fascinating, deftly paced tale." (Metro.co.uk)

"Vanity Fair Contributing Editor Vicky Ward serves up a book about an investment bank that is a spicy, dishy dish . . . Ward builds a convincing case that duplicity and betrayal in the mid-'90s eventually led to the demise of Lehman Brothers." (Bloomberg BusinessWeek)

"...The Devil's Casino has everything readers might want to know about the personal foibles and shopping habits of key Lehman leaders and their wives...a fascinating read." (Financial Times)

"What's remarkable about this narrative is that Ward...manages to humanize many of the central figures involved in the rise and fall of one of Wall Street's largest firms, offering profound insight into the titans of finance whose recklessness, greed, and competitiveness brought the US economy to the brink of collapse. The story plays out like a Shakespearean tragedy (Ward even includes a "Cast of Characters") in which the very principles upon which the firm was built prove to be its undoing. . . The Devil's Casino. offers a fascinating glimpse into the culture of one of the most powerful firms on Wall Street. One hopes that the history it chronicles will also serve as a cautionary tale for the financial industry's still-uncertain future." (The Boston Globe)

"In a terrific book Vicky Ward takes us into the heart of the denial machine. Hers is the story of Lehman Brothers, then Wall Street's fourth largest investment bank, soon to be its biggest casualty. . . Ward takes us into the world of these bankers, and shows us the lives they were leading in the years before the crash. At first, they saw themselves as "good guys" -- bankers who would not become blinded by greed. But then they began to see how much money could be made and their lifestyles changed. They did not seem to be their old selves any more. This is what Ward does so well: she shows us the world of private jets and helicopters, the women with personal shoppers and shelves full of unworn shoes. She shows us how it is that people, even though they are multi-millionaires, can still have an addict's desperation for money." (The Guardian)

In the fall of 2008, the 150-year-old financial institution Lehman Brothers spectacularly melted down. The liquefied remains then ignited, joining the worldwide conflagration that became the great recession that is now either over or not, depending on whom you talk to. In short order, a host of formerly rock-solid institutions showed cracks that ran all the way from their foundations to the aeries occupied by their greedy, ineffective senior management. Firms that once represented all that was trustworthy in our financial system teetered, then fell. Even insurance companies that were responsible for the welfare of others were revealed to be the oldest permanent floating craps game in New York.

"Vicky Ward's "The Devil's Casino" is an able new entrant into this crowded genre, and people who hate losers who are not their friends should enjoy it very much. It chronicles the sad and messy end of the House of Lehman in a relatively terse and fast-moving 270 pages, making it a mere social X-ray of a book by today's standards of nonfiction heft, which often rivals the unsecured debt load of a failed bank. Ward carefully and skillfully tracks the last 25 or so years of the great, doomed enterprise, and her portrait of a business entity is often engaging, spicy and amusing. I particularly enjoyed the horror stories about those few, strategically challenged souls who had the temerity not to learn golf. Theirs was a demise that only outsiders to our fascist corporate golfing culture can appreciate. And the tick-tock of deals, fads, decisions and transactions that took place over a very long time can be exciting. The book also does a fine job of sketching several outlandishly banal individuals who rose to prominence in the firm and ultimately were responsible, each in a different way, for its demise." (The Washington Post)

"Vicky Ward is a British export to New York, with a degree in English Literature - and it shows. She writes stylishly and she understands, unlike other authors who have rushed into print with accounts of the financial crisis, that enduring literature is not created by unravelling transactions but by illuminating complex personalities." (Mail on Sunday)

"Vicky Ward's The Devil's Casino is an able. entrant into this crowded genre, and people who hate losers who are not their friends should enjoy it very much. It chronicles the sad and messy end of the House of Lehman in a relatively terse and fast-moving 270 pages. Ward carefully and skillfully tracks the last 25 or so years of the great, doomed enterprise, and her portrait of a business entity is often engaging, spicy and amusing. The book also does a fine job sketching several outlandishly banal individuals who rose to prominence in the firm and ultimately were responsible, each in a different way, for its demise." (Stanley Bing, The Free Press)

"A terrific tale of the weird and not-so-wonderful world of Lehman Brothers: the personalities, the bonuses, and best of all the backstabbing politics of the Louboutin-shod bankers' Wags. The now-vilified former CEO, Richard Fuld , is portrayed not just as the aggressive "Gorilla" of Wall Street lore but as a human sponge who absorbed the attributes of smarter colleagues to the point of stealing their entire personality." (The Guardian)

"The Devil's Casino, well researched, chatty, lively, sets itself up as a successor to Greed and Glory on Wall Street, Ken Auletta's 1986 book about Lehman. But the clichés of business articles are too frequent here: standing ovations on the trading floor, the rich wife's shoe collection and so on. . . as she charts the rivalries of life on Wall Street, Ward entertains with rich detail: the rough-edged Fuld taking elocution lessons and copying the nail-clipping habits of a smoother senior whose job he desires; Henry Kissinger at a board meeting, stirring his iced tea with a pencil. Ward shows that more than two decades ago, Lehman was developing dodgy habits that would cause trouble later. For example, it used a secret cash cushion known as "Dick's reserve" to polish its results at the end of each quarter. The book skillfully depicts the lives lived in the background of great clashing events. And it also hints at what Wall Street has become since the crisis, at the apparent dominance of two survivors, Goldman Sachs and JPMorgan Chase." (The New York Times)

"...Die Journalistin Vicky Ward, bestens in New York vernetzt, hat hinter die Kulissen von Lehmann geschaut und mit vielen aus der Führungsebene gesprochen. Ihr Buch "The Devil's Casino" deckt auf, dass Lehmann den Kern des Scheiterns eigentlich schon seit dem Börsengang 1994 in sich trug..." -- Handelsblatt, 09.04.10'...her book glows because of the poignancy of the Mad Men-like human story at its core.' (Spectator Business, June 2010)

'...Ward skitters between financial reportage and human interest to tell a clear modern history of the cat with nine lives...' (The New Economy, July 2010)

"A gripping, gossipy account of the rise and fall of Lehman Brothers which reads like a novel." (Financial Times Weekend, June 2010)

"Ward sheds light on the four childhood friends who planned to take the financial world by storm while keeping their heads on their shoulders, and how quickly the second part of the play fell by the wayside amidst a brutal corporate coup and bumbling mismanagement that brought the firm down. The Devil's Casino serves as both an impressive work of investigative journalism and a cautionary tale of the culture surrounding American finance." (The Daily Beast)

"Ward's book is rich on details . . . when Ward connects the dots, the rough conclusion she comes up with is that fatal flaws of Fuld's culture brought Lehman down." (Reuters)

"A fascinating, deftly paced tale." (Metro.co.uk)

"Vanity Fair Contributing Editor Vicky Ward serves up a book about an investment bank that is a spicy, dishy dish . . . Ward builds a convincing case that duplicity and betrayal in the mid-'90s eventually led to the demise of Lehman Brothers." (Bloomberg BusinessWeek)

"...The Devil's Casino has everything readers might want to know about the personal foibles and shopping habits of key Lehman leaders and their wives...a fascinating read." (Financial Times)

"What's remarkable about this narrative is that Ward...manages to humanize many of the central figures involved in the rise and fall of one of Wall Street's largest firms, offering profound insight into the titans of finance whose recklessness, greed, and competitiveness brought the US economy to the brink of collapse. The story plays out like a Shakespearean tragedy (Ward even includes a "Cast of Characters") in which the very principles upon which the firm was built prove to be its undoing. . . The Devil's Casino. offers a fascinating glimpse into the culture of one of the most powerful firms on Wall Street. One hopes that the history it chronicles will also serve as a cautionary tale for the financial industry's still-uncertain future." (The Boston Globe)

"In a terrific book Vicky Ward takes us into the heart of the denial machine. Hers is the story of Lehman Brothers, then Wall Street's fourth largest investment bank, soon to be its biggest casualty. . . Ward takes us into the world of these bankers, and shows us the lives they were leading in the years before the crash. At first, they saw themselves as "good guys" -- bankers who would not become blinded by greed. But then they began to see how much money could be made and their lifestyles changed. They did not seem to be their old selves any more. This is what Ward does so well: she shows us the world of private jets and helicopters, the women with personal shoppers and shelves full of unworn shoes. She shows us how it is that people, even though they are multi-millionaires, can still have an addict's desperation for money." (The Guardian)

In the fall of 2008, the 150-year-old financial institution Lehman Brothers spectacularly melted down. The liquefied remains then ignited, joining the worldwide conflagration that became the great recession that is now either over or not, depending on whom you talk to. In short order, a host of formerly rock-solid institutions showed cracks that ran all the way from their foundations to the aeries occupied by their greedy, ineffective senior management. Firms that once represented all that was trustworthy in our financial system teetered, then fell. Even insurance companies that were responsible for the welfare of others were revealed to be the oldest permanent floating craps game in New York.

"Vicky Ward's "The Devil's Casino" is an able new entrant into this crowded genre, and people who hate losers who are not their friends should enjoy it very much. It chronicles the sad and messy end of the House of Lehman in a relatively terse and fast-moving 270 pages, making it a mere social X-ray of a book by today's standards of nonfiction heft, which often rivals the unsecured debt load of a failed bank. Ward carefully and skillfully tracks the last 25 or so years of the great, doomed enterprise, and her portrait of a business entity is often engaging, spicy and amusing. I particularly enjoyed the horror stories about those few, strategically challenged souls who had the temerity not to learn golf. Theirs was a demise that only outsiders to our fascist corporate golfing culture can appreciate. And the tick-tock of deals, fads, decisions and transactions that took place over a very long time can be exciting. The book also does a fine job of sketching several outlandishly banal individuals who rose to prominence in the firm and ultimately were responsible, each in a different way, for its demise." (The Washington Post)

"Vicky Ward is a British export to New York, with a degree in English Literature - and it shows. She writes stylishly and she understands, unlike other authors who have rushed into print with accounts of the financial crisis, that enduring literature is not created by unravelling transactions but by illuminating complex personalities." (Mail on Sunday)

"Vicky Ward's The Devil's Casino is an able. entrant into this crowded genre, and people who hate losers who are not their friends should enjoy it very much. It chronicles the sad and messy end of the House of Lehman in a relatively terse and fast-moving 270 pages. Ward carefully and skillfully tracks the last 25 or so years of the great, doomed enterprise, and her portrait of a business entity is often engaging, spicy and amusing. The book also does a fine job sketching several outlandishly banal individuals who rose to prominence in the firm and ultimately were responsible, each in a different way, for its demise." (Stanley Bing, The Free Press)

"A terrific tale of the weird and not-so-wonderful world of Lehman Brothers: the personalities, the bonuses, and best of all the backstabbing politics of the Louboutin-shod bankers' Wags. The now-vilified former CEO, Richard Fuld , is portrayed not just as the aggressive "Gorilla" of Wall Street lore but as a human sponge who absorbed the attributes of smarter colleagues to the point of stealing their entire personality." (The Guardian)

"The Devil's Casino, well researched, chatty, lively, sets itself up as a successor to Greed and Glory on Wall Street, Ken Auletta's 1986 book about Lehman. But the clichés of business articles are too frequent here: standing ovations on the trading floor, the rich wife's shoe collection and so on. . . as she charts the rivalries of life on Wall Street, Ward entertains with rich detail: the rough-edged Fuld taking elocution lessons and copying the nail-clipping habits of a smoother senior whose job he desires; Henry Kissinger at a board meeting, stirring his iced tea with a pencil. Ward shows that more than two decades ago, Lehman was developing dodgy habits that would cause trouble later. For example, it used a secret cash cushion known as "Dick's reserve" to polish its results at the end of each quarter. The book skillfully depicts the lives lived in the background of great clashing events. And it also hints at what Wall Street has become since the crisis, at the apparent dominance of two survivors, Goldman Sachs and JPMorgan Chase." (The New York Times)

"...Die Journalistin Vicky Ward, bestens in New York vernetzt, hat hinter die Kulissen von Lehmann geschaut und mit vielen aus der Führungsebene gesprochen. Ihr Buch "The Devil's Casino" deckt auf, dass Lehmann den Kern des Scheiterns eigentlich schon seit dem Börsengang 1994 in sich trug..." -- Handelsblatt, 09.04.10'...her book glows because of the poignancy of the Mad Men-like human story at its core.' (Spectator Business, June 2010)

'...Ward skitters between financial reportage and human interest to tell a clear modern history of the cat with nine lives...' (The New Economy, July 2010)

"A gripping, gossipy account of the rise and fall of Lehman Brothers which reads like a novel." (Financial Times Weekend, June 2010)

"...Die Journalistin Vicky Ward, bestens in New York vernetzt, hat hinter die Kulissen von Lehmann geschaut und mit vielen aus der Führungsebene gesprochen. Ihr Buch "The Devil's Casino" deckt auf, dass Lehmann den Kern des Scheiterns eigentlich schon seit dem Börsengang 1994 in sich trug..."

Handelsblatt, 09.04.10

Handelsblatt, 09.04.10